Whiskey neat, anyone? Wait, scratch that—let’s talk money first. You’d think managing investments is as straightforward as sipping a cold brew on a lazy Sunday, but here’s the kicker: ignoring when to rebalance your portfolio can turn your nest egg into a cracked shell. I’ve seen folks ride the market highs only to crash hard when things shift, losing potential gains because they didn’t tweak their asset allocation. This article dives into the real deal on when to rebalance your portfolio, helping you sleep better at night knowing your investments are aligned with your goals. Stick around, and you’ll walk away with practical tips to keep your financial house in order, without the jargon overload.

That Wild Ride I Took with My Own Stocks

Picture this: back in 2018, I was knee-deep in tech stocks, thinking I was the next Warren Buffett. My portfolio was heavily weighted towards high-fliers like Apple and Amazon, and honestly, it felt exhilarating—like binge-watching a Marvel marathon where every episode ends on a cliffhanger. But then the market hiccupped, and suddenly, my balanced mix turned into a tech-heavy mess. I remember staring at my screen, coffee going cold, as values plummeted. That was my wake-up call; I hadn’t rebalanced in over a year.

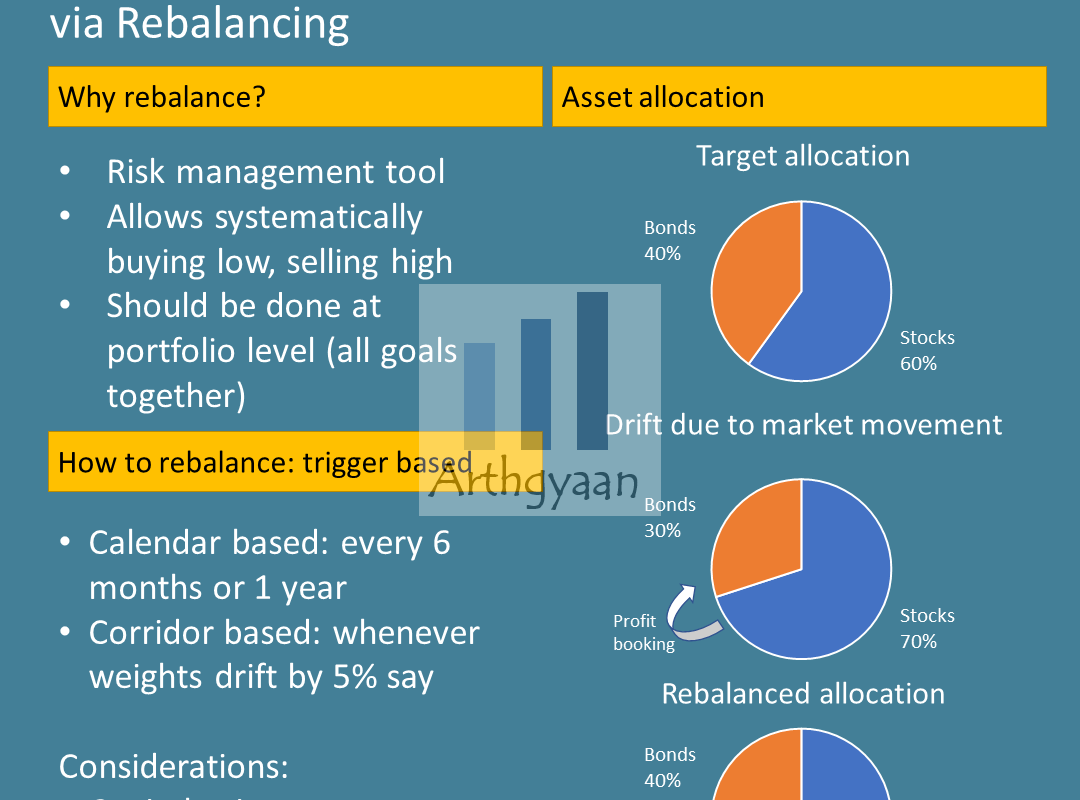

This personal blunder taught me a hard lesson: rebalancing your investment portfolio isn’t about micromanaging; it’s about maintaining that sweet spot of risk and reward. If you let winners run too far, they can dominate your assets, exposing you to unnecessary volatility. In my case, what started as a diversified strategy ended up skewed, and it cost me. Now, I swear by checking in every six months or so, especially when life throws curveballs like job changes or market swings. And just like in «The Wolf of Wall Street,» where Jordan Belfort’s empire crumbles from overreach, overexposure can bite you hard if you’re not careful.

Gardening Lessons from Ancient Empires

Ever heard of the Hanging Gardens of Babylon? Those ancient wonders weren’t just pretty; they required constant upkeep to thrive amidst the desert sands. Similarly, portfolio rebalancing strategies demand regular attention to keep your investments blooming. Think about it: just as Babylonian engineers pruned and adjusted to maintain balance, you need to trim overgrown assets and replant in underperformers.

In a more modern twist, compare this to how Japanese bonsai artists meticulously shape their trees—it’s not about force, but gentle nudges over time. If your stocks have ballooned due to a bull run, say in renewable energy sectors, you might find your allocation straying from your original plan. Historically, empires like Rome fell when they ignored imbalances, much like how unchecked inflation can erode your gains. Here’s a quick table to illustrate the pros and cons of different rebalancing approaches, drawing from real-world investor behaviors:

| Approach | Advantages | Disadvantages |

|---|---|---|

| Time-based (e.g., annually) | Simple and disciplined, reduces emotional decisions | May miss timely market shifts, like rapid tech booms |

| Threshold-based (e.g., 5% deviation) | Responds to actual changes, potentially locking in gains | Can lead to frequent trades and higher fees |

As someone who’s dabbled in international markets, I find this cultural analogy spot-on—it’s like how British «pound for pound» trading once ruled, but needed adjustments during economic shifts. Y’know, money talks, and in the U.S., we’ve got our own flair for adaptive strategies. Don’t just take my word; imagine chatting with a skeptical friend: «Sure, rebalancing sounds tedious, but wait until your retirement fund thanks you later.»

When Your Investments Decide to Throw a House Party

Okay, let’s get real—picture your portfolio as that friend who starts a house party without inviting you. One minute, it’s a chill gathering; the next, the neighbors (a.k.a. market risks) are complaining. Irony hits when you realize you’ve let things spiral because, hey, who has time for asset allocation tweaks amid daily life? But here’s the fix: set clear thresholds, like rebalancing when any asset class deviates by 5% from your target. And that’s when it hit me—procrastination costs money.

To make this actionable, try this mini experiment: grab your latest statement and jot down your current percentages. If equities are hogging the spotlight while bonds are in the corner, it’s time to play DJ and mix it up. For instance, if you’ve got a growth-oriented setup, aim to sell off winners and buy into laggards. This isn’t rocket science; it’s like fixing a wonky bike wheel before the big ride. Under the weather with market news? That’s no excuse—automate it through your brokerage. By addressing imbalances with a dash of humor, you turn potential pitfalls into smart moves, keeping your investments as steady as a good cup of tea.

In wrapping this up, here’s a twist: what if rebalancing isn’t just about money, but about reclaiming control in an unpredictable world? So, here’s your call to action—dive into your portfolio right now and schedule that next check-in. It could be the difference between coasting and crashing. And finally, have you ever stopped to think: how does ignoring these adjustments affect your long-term dreams, like that beach house you’ve always wanted? Drop your thoughts in the comments; let’s keep the conversation going.