Chaos in the markets. Yep, that’s the unfiltered truth about investing—it’s like trying to surf a tsunami one day and lounging on calm waters the next. But here’s the kicker: while everyone dreams of steady gains, **market volatility** hits us all, turning portfolios into emotional rollercoasters. In 2020 alone, the S&P 500 swung wildly, dropping 34% in a month before rebounding, proving that ignoring fluctuations is like ignoring a ticking bomb in your backyard. This article dives into practical **strategies for market volatility management**, helping you, the everyday investor, stay sane and profitable. By the end, you’ll grasp how to turn uncertainty into your ally, without the usual hype—just real talk on **investment strategies** that work.

Remember That Wild Ride in My Garage? A Personal Tale of Stock Surprises

Okay, picture this: back in 2008, I was a fresh-faced investor, thinking I’d nailed it with a bunch of tech stocks. And just like that, the market tanked, wiping out a chunk of my savings faster than a kid devours Halloween candy. I remember staring at my screen, heart pounding, muttering, «What the heck just happened?» It was my first real brush with **stock market fluctuations**, and boy, did it teach me a lesson. Instead of panicking, I started **diversifying my investments**—spreading bets across bonds, real estate, and even some international funds. That mix kept me afloat when things got hairy. See, volatility isn’t just a beast; it’s a teacher. In my opinion, based on years of trial and error, the key is emotional discipline—don’t let fear drive the bus. Think of it like that meme of the dog in a burning room saying, «This is fine.» Sure, it’s sarcastic, but it reminds us to stay cool. By weaving in assets that don’t all move in sync, you buffer against shocks, making **risk management in investments** feel less like a gamble and more like a calculated game. And honestly, if I’d stuck to one stock back then, I’d still be kicking myself.

Volatility: When Finance Meets the Rollercoaster of History

Ever notice how market ups and downs echo the drama of ancient epics? Take the Roaring Twenties in the U.S., where stocks soared like they were invincible, only for the Great Depression to crash the party—sound familiar? It’s like comparing Wall Street to a Wild West showdown, where one minute you’re the sheriff, and the next, you’re dodging bullets from unexpected events like pandemics or elections. But here’s a truth that’s often swept under the rug: while volatility feels chaotic, it’s also where fortunes are made, as seen in the dot-com bubble’s aftermath, where savvy investors scooped up bargains. In contrast to that era, today’s **hedging techniques** offer modern tools, like options or futures, to soften blows without losing sleep. Don’t put all your eggs in one basket, as the old American saying goes; instead, blend in commodities or ETFs for that extra layer of protection. This historical lens shows that **market volatility management** isn’t new—it’s evolved, giving us edges our great-grandparents didn’t have. Imagine a conversation with a skeptical reader: «But wait, isn’t hedging just for the big shots?» I’d say, nah, it’s accessible now, and with platforms like Robinhood, even the average Joe can dip their toes. The real twist? Embracing volatility as opportunity, not enemy, turns the tide in your favor.

A Quick Spin on Diversification Myths

Let’s bust one myth real quick: not all diversification is created equal. Some folks think throwing money at random stocks does the trick, but that’s like mixing oil and water—it doesn’t blend. Focus on uncorrelated assets for true balance.

When the Market Throws a Tantrum, Laugh It Off and Rebalance

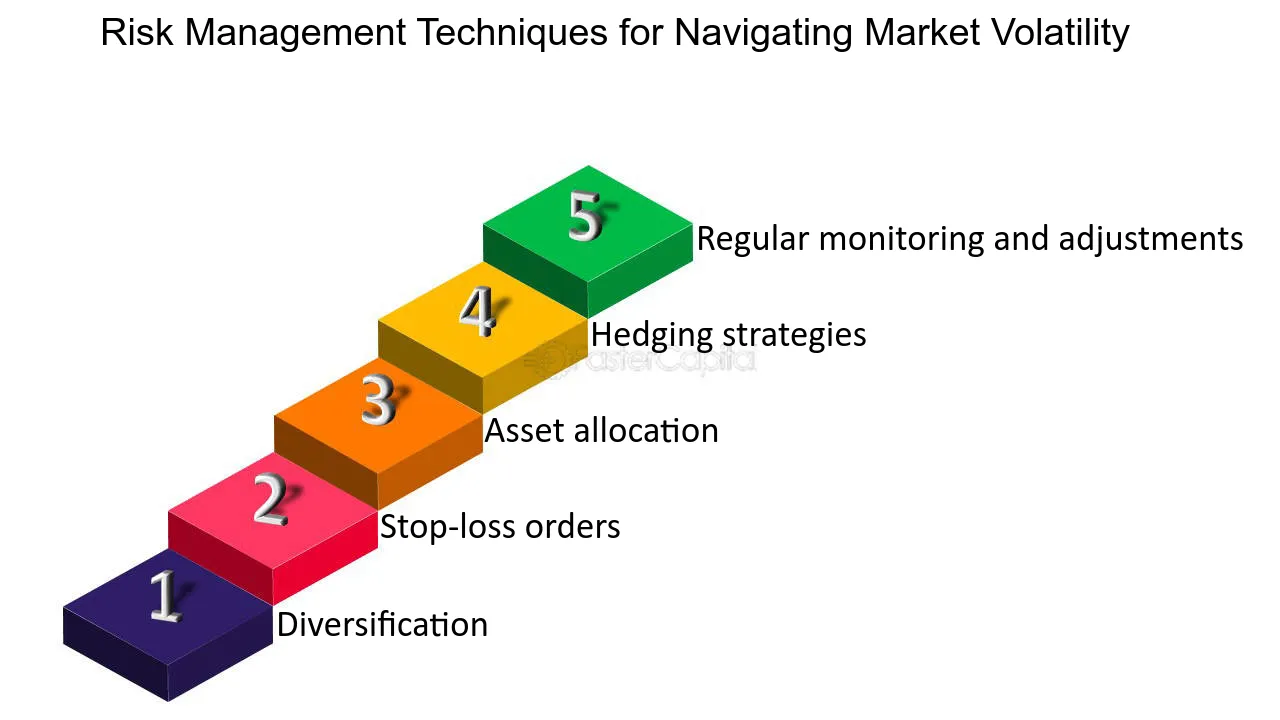

Alright, let’s get real—markets can be total drama queens, spiking and dipping over nothing, leaving you wondering, «Is this the end or just another blip?» Take my friend’s portfolio last year; he watched his tech-heavy setup nosedive during a random news cycle, and instead of freaking out, he cracked a joke: «Guess it’s time for that vacation fund to save the day.» That’s the irony: volatility often exposes over-reliance on hot sectors, but with a relaxed approach, you can flip it. Start by **rebalancing your portfolio** regularly—say, every six months—to keep things steady. Step 1: Review your asset allocation; if stocks have ballooned, trim them and boost bonds. Step 2: Consider dollar-cost averaging, where you invest fixed amounts over time, smoothing out the highs and lows. And 3: Don’t shy from hedging, like buying put options as a safety net—it’s not overkill; it’s smart. In a world obsessed with get-rich-quick schemes, this method feels like a breath of fresh air, especially when you reference something like «The Wolf of Wall Street,» where unchecked greed leads to downfall. But me? I prefer the steady path; it’s like riding a bike—wobbles happen, but you keep pedaling. Y’know, and just when you think it’s all lost…

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Diversification | Reduces risk across assets; promotes long-term growth | May lower potential returns if one area booms |

| Hedging | Protects against downturns; gives peace of mind | Costs money upfront; can complicate investments |

| Rebalancing | Maintains your risk tolerance; easy to implement | Requires regular monitoring; taxes might apply |

Wrapping It Up: Volatility as Your Secret Weapon

So, here’s the plot twist: what if I told you that **market volatility** isn’t the villain, but a gateway to smarter **investments**? Instead of dreading it, view it as a chance to buy low and shine when things stabilize. Your call to action? Dive into your portfolio right now—audit those holdings and add a diversification tweak, even if it’s just shifting 10% to safer bets. And ponder this: in a world of endless fluctuations, what’s one strategy you’ve overlooked that could change your financial game? Share in the comments; let’s keep the conversation rolling, folks.