Whispers of wealth, taxes lurking. Ever feel like your hard-earned investment gains are just a juicy target for the taxman? Here’s the twist: you don’t have to hand over more than necessary. In this relaxed chat about tax-efficient investing methods, we’ll dive into smart strategies that keep more money in your pocket—without the stuffy financial jargon. Imagine turning your portfolio into a stealthy ninja, dodging fees and taxes while growing steadily. By the end, you’ll have practical tips to make your investments work smarter, not harder, saving you time, stress, and yes, cash. Stick around; it’s easier than you think, and way more rewarding.

My Bumbling Start in Investing and the Lightbulb Moment

Picture this: a few years back, I was that guy—eager but clueless—diving into stocks with the enthusiasm of a kid in a candy store. I poured money into high-fliers, thinking, «This is it, I’m set.» But come tax season, oof, the bite was real. I ended up owing a chunk because I hadn’t factored in capital gains taxes. It was like realizing halfway through a marathon that you’re wearing flip-flops. That experience taught me the hard way about **tax-efficient investing** strategies, like using tax-advantaged accounts to shield gains.

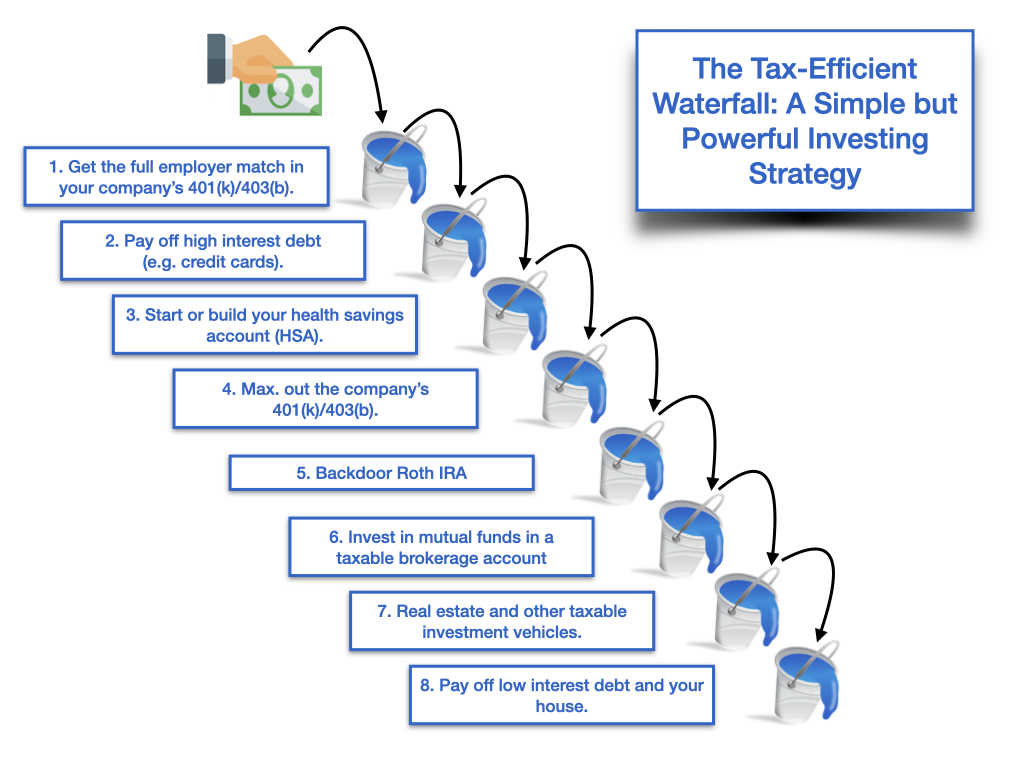

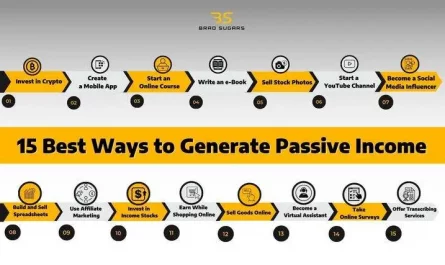

Opinions vary, but mine? Tax-loss harvesting is a game-changer for everyday investors. It’s not just for Wall Street whizzes; it’s about selling off losers to offset winners, reducing your taxable income. I remember chatting with a buddy in London—he called it «dodging the HMRC dragon,» a nod to our shared love for British telly like «Game of Thrones.» And that’s when it hit me: why not make investing feel less like a chore and more like outsmarting a dragon? In the U.S., it’s piece of cake with tools like IRA or 401(k) plans, which defer taxes until withdrawal. But beware, over-reliance can lead to surprises if markets dip. By weaving in these methods, you’re not just investing; you’re building a fortress around your future wealth.

Tax Shenanigans: From Pharaohs to Your Couch

Ever compare ancient tax dodges to modern-day maneuvers? Back in Egypt, pharaohs hoarded grain to avoid levies—talk about early **investment strategies**. Fast-forward to today, and it’s all about using index funds or ETFs that minimize turnover, keeping capital gains taxes low. It’s like swapping a noisy city commute for a quiet bike path; less friction means more efficiency.

Here’s a truth that might ruffle feathers: not all «safe» investments are truly tax-friendly. Bonds, for instance, can get hit with ordinary income taxes, whereas municipal bonds offer tax-free interest in many cases. Let’s break it down in a simple table to compare:

| Investment Type | Tax Treatment | Pros | Cons |

|---|---|---|---|

| Index Funds | Lower capital gains due to infrequent trading | Cost-effective and diversified | Market volatility can affect returns |

| Municipal Bonds | Often tax-exempt at federal level | Stable income, especially for high-tax brackets | Lower yields compared to corporate bonds |

| Roth IRA | Tax-free withdrawals after age 59½ | Growth compounds without tax drag | Contributions aren’t tax-deductible upfront |

This comparison shows how **tax-efficient methods** aren’t one-size-fits-all; it’s about your situation. Throw in a cultural twist—like how Americans obsess over «The Wolf of Wall Street» memes for get-rich-quick vibes—while Brits might reference «Only Fools and Horses» for savvy bartering. Either way, the key is balance; don’t chase trends without considering the tax hit. It’s almost ironic how something as old as grain storage parallels today’s ETF plays, proving that smart investing evolves, but the core idea stays: protect what you’ve got.

That Pesky Tax Trap and How I Sidestepped It with a Chuckle

Okay, let’s get real for a sec: who hasn’t panicked over a surprise tax bill? I once overlooked qualified dividends, thinking all income was treated the same—boy, was I wrong. It’s like ordering pizza and getting charged for the box separately. But instead of stressing, I flipped it with humor: imagine your investments as a stand-up comedy routine, where the punchline is minimizing taxes through qualified accounts.

To tackle this, start with a mini-experiment: track your current holdings and calculate potential taxes using free online calculators. You’ll see how shifting to **reduce taxes on investments** via strategies like asset location—putting high-growth assets in tax-deferred accounts—can save you bucks. For instance, if you’re in a high-tax state, favoring municipal bonds isn’t just smart; it’s like giving the taxman a polite «no thanks.» And bob’s your uncle, you’ve got a plan. This approach isn’t perfect—markets fluctuate, after all—but it’s a step toward that relaxed investing life we all crave. Y’know, the one where your portfolio grows without the drama.

Wrapping this up with a fresh spin: what if I told you that tax-efficient investing isn’t about being a finance guru, but about making small, savvy choices that add up? So, here’s your call to action—grab a notebook and jot down one **tax-efficient investing tip** from today, then apply it to your next trade. What unexpected windfall have you missed out on due to taxes, and how will you change that? Share in the comments; let’s keep the conversation going, folks.