Money whispers secrets. Wait, hear me out—it’s not the dramatic blockbuster you see in movies, but opening a brokerage account? That’s your ticket to making those whispers shout. I remember thinking investing was for suits on Wall Street, yet here I am, an average joe who turned a coffee budget into a growing nest egg. The problem? Most folks hesitate, tangled in paperwork fears, missing out on building wealth that could fund dreams. But stick around, and I’ll walk you through the steps to open a brokerage account, relaxed style, so you can start investing wisely without the stress. By the end, you’ll see it’s simpler than binge-watching your favorite series, and yeah, it might just change how you view your bank balance forever.

My Bumpy Ride into Brokerage – A Tale of Triumph and Facepalms

Picture this: five years ago, I was glued to my couch, scrolling through memes about getting rich quick, when a buddy dragged me to open my first brokerage account. It was messy—think of it like trying to assemble IKEA furniture blindfolded. I chose a popular online broker on a whim, ignoring fees that later nipped at my profits. But here’s the real story: after fumbling through the app setup, watching my initial $500 investment inch up, I learned that researching brokers is key. It’s not just about picking one; it’s about finding a match for your lifestyle. My opinion? If you’re in the US, platforms like Vanguard feel like a trusty old friend—low costs, solid tools—versus the flashy ones that charge like a high-maintenance date.

And just when I thought I’d nailed it… fees snuck up, eating into gains. That’s the human side—mistakes make us smarter. In my neck of the woods, we say «don’t count your chickens before they hatch,» meaning don’t assume every trade’s a winner. This anecdote taught me that opening a brokerage account isn’t a sprint; it’s a marathon with pit stops for learning. Use analogies like comparing brokers to coffee shops: some are quick and cheap, others premium with perks. By weaving in personal details, like how I celebrated my first dividend with pizza, I hope you see investing as relatable, not intimidating.

From Wall Street Wolves to App Wizards: A Wild Evolution

Ever watched «The Wolf of Wall Street» and thought, «That was then, but what about now?» Yeah, me too—it’s like comparing a flip phone to your smartphone. Back in the day, opening a brokerage meant suits, handshakes, and hefty minimums, but today? It’s as easy as downloading an app, thanks to fintech revolutions. This comparison highlights how brokerage account options have democratized investing, making it accessible for everyday folks, not just the elite.

Take cultural shifts: in the US, we went from the NYSE’s roaring twenties to Robinhood’s meme-stock mania. It’s ironic—tools meant for the pros are now in our pockets, yet myths persist that you need thousands to start. The truth? Many brokers let you open with peanuts, like $0 for some. Here’s a twist: imagine a conversation with a skeptical reader. «But what if I lose it all?» you’d say. I’d reply, «That’s why education’s your shield, buddy. Start small, learn the ropes.» This evolution isn’t just historical; it’s a wake-up call. Propose this mini experiment: pick two brokers, compare their apps for a week. You’ll find, as I did, that modern platforms offer educational resources that make steps to invest feel like leveling up in a game, not a chore.

The Hilarious Hurdles of Account Openings – And How to Leap Over Them

Okay, let’s get real with some irony: I once spent an hour uploading the wrong ID, thinking it was «close enough,» only to get rejected faster than a bad joke at a party. Opening a brokerage account sounds straightforward, but pitfalls like verification woes or overlooking account types can trip you up. It’s like planning a road trip without checking the gas—frustrating, but fixable with a laugh.

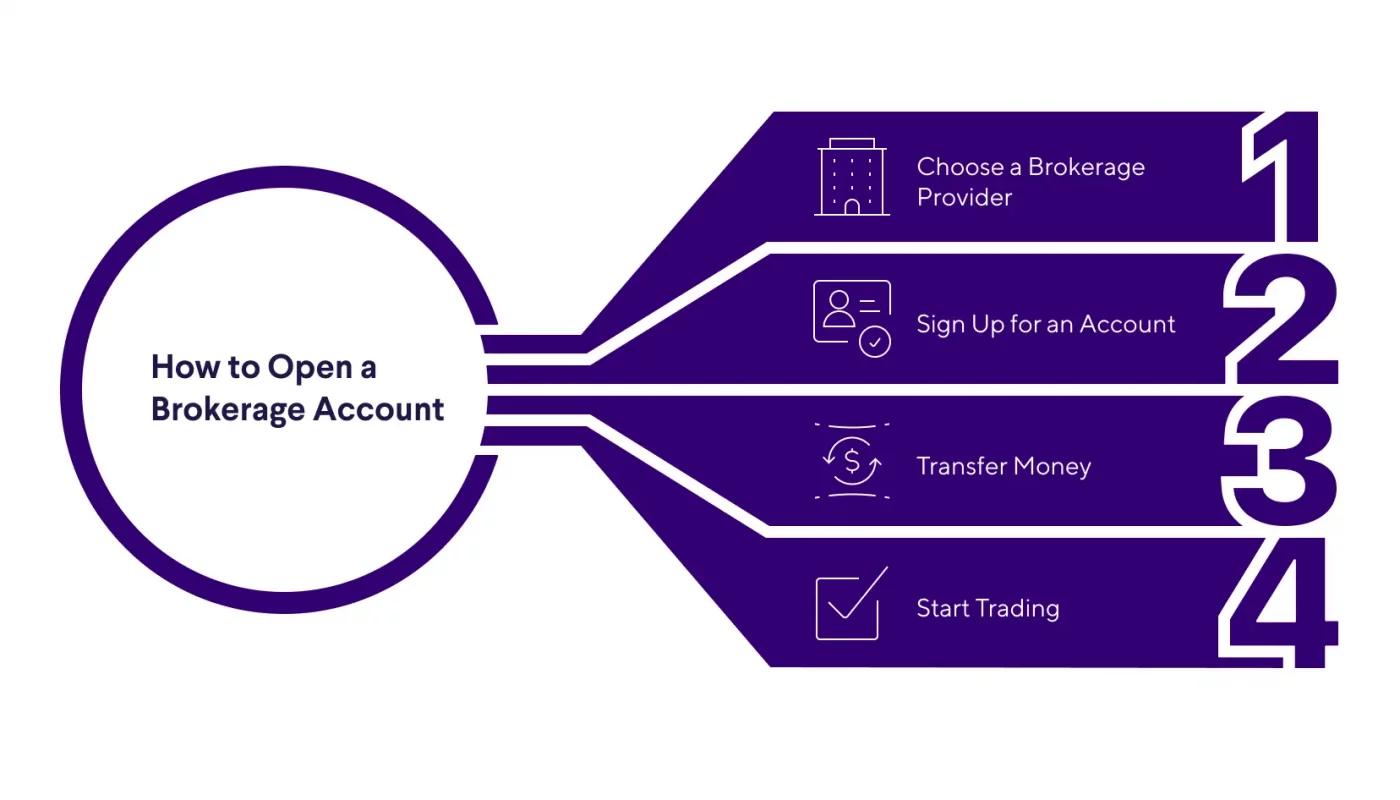

To tackle this, let’s break it down without a rigid list—think of it as chatting over coffee. First, decide on your account type: brokerage for trading stocks, or perhaps a Roth IRA if you’re eyeing retirement. In the US, it’s a piece of cake once you know: online brokers often guide you through. Compare this simply:

| Broker | Pros | Cons |

|---|---|---|

| Vanguard | Low fees, great for long-term; feels like a reliable buddy. | Limited options for active traders. |

| Robinhood | Free trades, user-friendly app; perfect for beginners dipping toes. | Fewer research tools, can encourage risky moves. |

This table shows why choosing wisely matters—balance fees with features. And that’s when it hit me: personalization is key. Don’t put all your eggs in one basket; diversify your investments once you’re in. For SEO without force, remember phrases like how to start investing tie into real advice. By exposing these problems with humor, the solution emerges: verify documents upfront, read the fine print, and boom—you’re set.

Wrapping this up with a twist: investing through a brokerage isn’t just about numbers; it’s about crafting a future where your money works for you, not the other way around. And hey, make it happen—open a brokerage account today by visiting a trusted site and following those steps we covered. What’s one change you’d make to your financial habits right now? Drop a comment; let’s chat about turning whispers into roars.