Bonds aren’t boring. Wait, hear me out—those sleepy financial instruments that your grandpa swears by can actually be the unsung heroes of your investment portfolio. I’ve seen folks dive into stocks, chasing the next big meme stock like it’s the latest Game of Thrones episode, only to overlook bonds and regret it later. But here’s the twist: in a world obsessed with high-risk, high-reward plays, bonds offer that steady, reliable heartbeat that keeps your finances from flatlining during a market meltdown. Think about it—while stocks might soar like dragons, bonds are more like the steadfast direwolves, loyal and protective. By the end of this tutorial, you’ll grasp the fundamentals of bond investing, helping you build a diversified strategy that’s as easy as pie and way less stressful than binge-watching your favorite series late into the night.

My First Bond Blunder and What I Learned

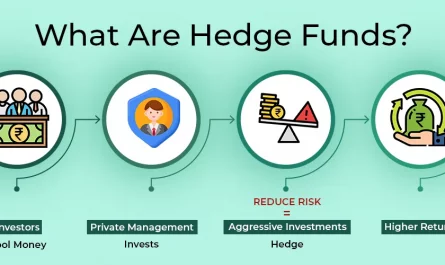

Okay, let’s get personal for a sec. Back in 2015, I jumped into bond investing with the enthusiasm of a kid unwrapping presents on Christmas morning, but without doing my homework. I bought a corporate bond from a company that sounded solid—think of it as me trusting a character in a Marvel movie who’s actually the villain in disguise. Fast forward a few months, and bam, interest rates rose, and my bond’s value tanked. I lost a couple hundred bucks, and let me tell you, that stung more than forgetting the plot twist in «Inception.» The lesson? Bonds aren’t set-it-and-forget-it; you need to understand yield, maturity, and credit risk. For beginners, bond investment fundamentals start with knowing that bonds are essentially loans you give to governments or companies, and they pay you back with interest. It’s like lending your buddy money for his food truck— as long as he’s reliable, you get your cash plus a little extra. But if he’s flaky, well, that’s where the risk creeps in. In my case, I learned to always check the credit rating, like double-checking reviews before streaming a show. And just like that plot hole in your favorite flick that makes you rethink everything, this experience taught me to diversify—mix in government bonds for safety alongside riskier corporate ones.

Bonds Through the Ages: A Timely Tale of Financial Stability

Picture this: during World War II, folks in the U.S. and UK bought war bonds not just as an investment, but as a patriotic duty, much like how people rallied behind Captain America in the comics. Fast forward to today, and how to invest in bonds has evolved, but the core idea remains— they’re a cornerstone of financial security. In Britain, we might say it’s «all part and parcel» of building wealth, while in the States, it’s as American as apple pie. Historically, bonds helped fund everything from empires to infrastructure, providing steady returns when stocks were as unpredictable as British weather. Compare that to now: modern Treasuries are like the reliable sidekick in a spy thriller, always there when the hero needs backup. But here’s a truth that’s a bit uncomfortable— many investors chase shiny stocks and ignore bonds, thinking they’re outdated, yet data from the past decade shows bonds have cushioned portfolios during downturns, like in 2008. If you’re skeptical, imagine chatting with a friend over tea: «Sure, bonds might seem dull, but when the market’s crashing, they’re the ones holding your hand.» This comparison highlights how basics of bond investing involve understanding their role in balancing risk, much like how ancient Roman aqueducts provided water while the empire partied— essential, yet often underappreciated.

Why Bonds Might Sneak Up and Save Your Bacon (Even When Stocks Hog the Limelight)

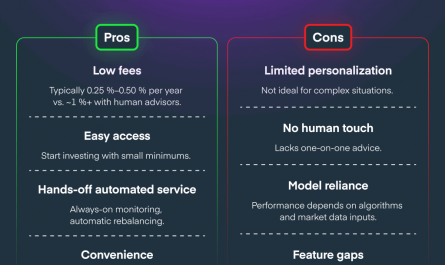

Alright, let’s address the elephant in the room— why bother with bonds when stocks can turn your investment into the next big blockbuster? Irony alert: I once thought bonds were for the financially faint-hearted, like choosing a cozy rom-com over an action flick, but boy was I wrong. The problem is, in our hype-driven world, we overlook that bonds offer fundamentals of investing in bonds like fixed income and lower volatility, which can be a game-changer during inflation spikes. Take the recent bond market fluctuations; it’s like that meme of the dog in a burning room staying calm— bonds help you weather the storm. For a solution with a dash of humor, start by evaluating bond types: government bonds are ultra-safe, almost like wearing a seatbelt, while municipal bonds offer tax perks that feel like finding money in an old coat pocket. And that’s when it hits you— by incorporating bonds, you’re not just investing; you’re strategizing. Propose this mini-experiment to yourself: grab a cup of coffee, look up current bond yields online, and compare them to stock dividends. You’ll see how a balanced portfolio, say 60% stocks and 40% bonds, can smooth out returns. It’s not about ditching the excitement; it’s about having a safety net, like Batman’s utility belt in the DC universe.

| Bond Type | Key Advantages | Potential Drawbacks |

|---|---|---|

| Government Bonds | Low risk, steady interest, government backing | Lower returns compared to stocks |

| Corporate Bonds | Higher yields, potential for growth | Company risk, interest rate sensitivity |

| Municipal Bonds | Tax-free interest, community support | Variable liquidity, state-specific risks |

Wrapping It Up With a Fresh Angle

Who’d have thought that diving into bond investment basics could flip your whole investment mindset on its head? It’s not just about numbers; it’s about peace of mind in an unpredictable world. So, here’s your call to action: right now, research a simple government bond through a reputable broker and add it to your portfolio— it’s easier than you think, and bob’s your uncle, you’ll feel more secure. And one last question to ponder: what’s that one investment choice you’ve made that taught you the most, and how might bonds fit into your story now? Share in the comments; let’s keep the conversation going.