Bumpy roads ahead. Yep, that’s right—three words that sum up what ignoring economic indicators can do to your investment portfolio. Here’s a shocker: while everyone’s chasing the next hot stock tip, statistics show that investors who regularly track key economic signals often see returns that are 20% higher over a decade. But let’s get real; in the world of investments, pretending everything’s fine is like ignoring a leaky roof until the whole house floods. The problem? Many folks skip these indicators, thinking they’re too complex or irrelevant, leading to knee-jerk decisions that tank their savings. The payoff for you, though, is crystal clear: smarter tracking means more secure, profitable investments, turning guesswork into a calculated game. And honestly, who wouldn’t want that edge in a market that’s as unpredictable as a plot twist in «Inception»?

That Time I Got Slapped by the Stock Market

Picture this: back in 2008, I was a wide-eyed newbie investor, convinced that my portfolio was bulletproof. I’d thrown money into tech stocks without a second glance at rising unemployment rates or that sneaky inflation creeping up. One day, I’m sipping coffee in my New York apartment, feeling like a Wall Street wizard, and the next, bam—my investments are in freefall. It was my wake-up call, folks. I remember thinking, «Why didn’t I see this coming?» Well, tracking economic indicators like GDP growth and job reports could have been my lifesaver. In my opinion, it’s not just about numbers; it’s personal. Ignoring them felt like driving without headlights on a foggy night—thrilling at first, but dangerously dumb.

That experience taught me a hard lesson: economic indicators aren’t boring stats; they’re the pulse of the market. For instance, when I finally started monitoring the unemployment rate, I noticed patterns that aligned with stock dips, almost like a secret code. And just to add a twist, think about how in American culture, we idolize the self-made investor, but even legends like Warren Buffett swear by these metrics. It’s ironic, right? We chase quick wins, yet the real wins come from that steady, behind-the-scenes work. Y’know, like how your grandma’s apple pie recipe isn’t flashy, but it’s what keeps everyone coming back.

Economic Pulse: More Reliable Than a Fortune Teller’s Crystal Ball

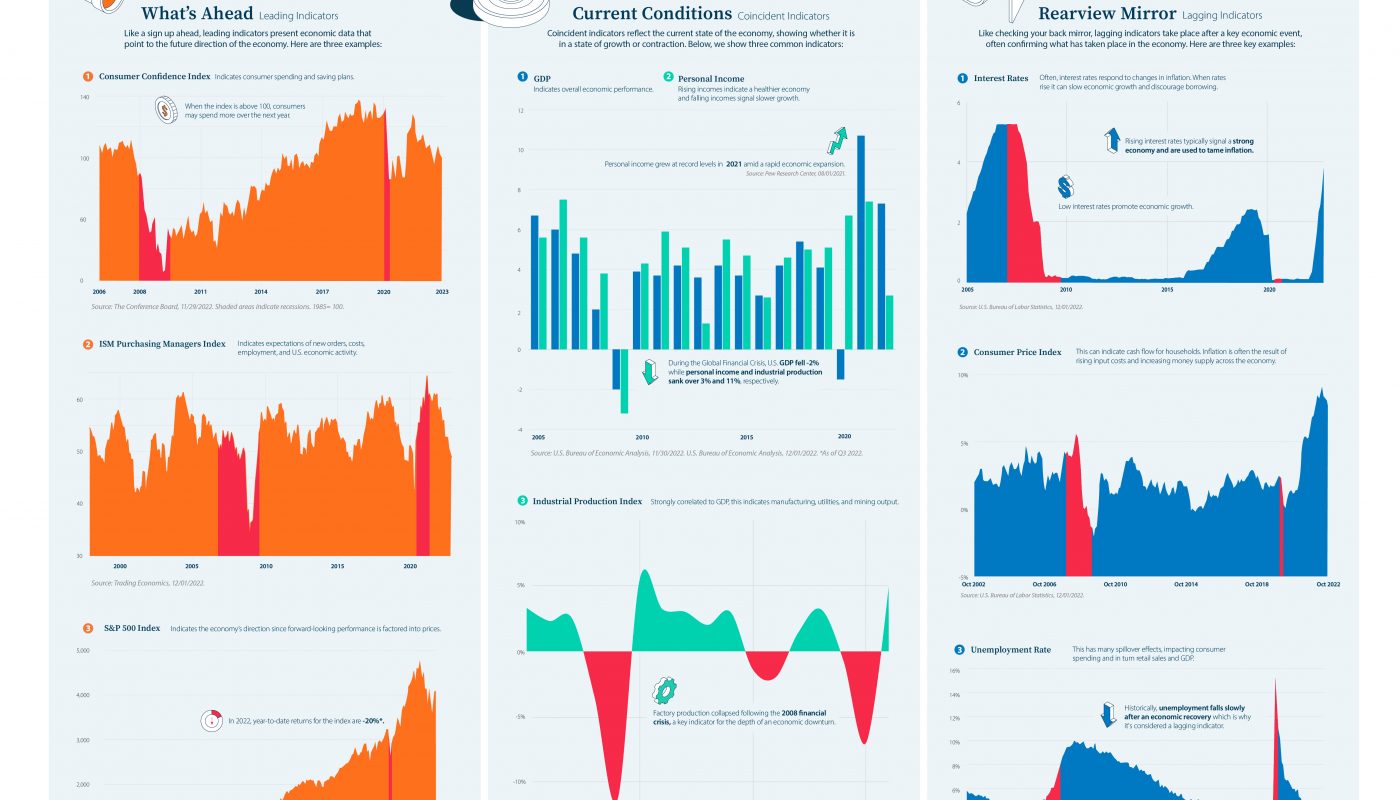

Ever compared economic indicators to ancient weather patterns? Hear me out—back in the days of Mayan civilizations, they tracked celestial events to predict harvests, much like how we use indicators to forecast market shifts. But here’s the truth bomb: unlike those old-school oracles, modern tools like inflation data or consumer confidence indexes are backed by cold, hard facts. In the U.S., we’ve got this obsession with «keeping up with the Joneses,» which mirrors how economic sentiment can drive investment trends—it’s all about perception turning into reality.

Let’s dive deeper with a quick comparison. Imagine economic indicators as your favorite weather app versus relying on gut feelings. Here’s a simple table to break it down:

| Aspect | Economic Indicators (e.g., GDP, Inflation) | Gut Feelings or Hype |

|---|---|---|

| Reliability | Based on official data, often accurate to within 1-2% | Emotional and subjective, leading to 50% error rates in predictions |

| Application in Investments | Helps spot recessions early, boosting long-term strategies | Often results in panic sells or overbuys, like in meme stock frenzies |

| Cultural Reference | Like the dependable weatherman in «Groundhog Day» | As unreliable as Bill Murray’s endless loops |

See what I mean? Tracking these isn’t just a piece of cake; it’s essential for anyone serious about investments. And if you’re skeptical, imagine chatting with a buddy over coffee: «Nah, man, I don’t need all that data—who cares about interest rates?» I’d counter with, «But dude, that’s like ignoring storm clouds because you’re in a good mood.» Exactly—economic indicators provide that broader context, turning vague hunches into actionable insights.

When Your Wallet Whispers Warnings (And How to Listen)

Alright, let’s address the elephant in the room: why does your investment strategy sometimes feel like it’s on a rollercoaster? It’s probably because you’re not tuning into those subtle economic vibes. Take inflation, for example—it’s like that friend who overstays their welcome at a party, quietly eating up your profits. In a relaxed tone, I’ll admit, I used to brush it off, thinking, «Eh, prices go up, big deal.» But then, boom, my returns shrunk faster than a cheap t-shirt in the wash.

The fix? Start with baby steps. First, pick one indicator, say the consumer price index, and track it alongside your stock picks. It’s not rocket science; think of it as leveling up in a video game—economic indicators for investments give you power-ups. And for a bit of humor, if your portfolio was a character in «The Office,» it’d be Michael Scott—full of enthusiasm but missing the big picture without these tools. By integrating long-term tracking, you’re not just reacting; you’re proactively dodging pitfalls, like swapping a flat tire before the road trip even starts.

In my view, this approach adds depth to your financial game, blending data with intuition. Y’know, it’s that «American dream» vibe, but with a safety net. And just when you think you’ve got it figured out…

A Final Twist: Don’t Just Track, Thrive

Here’s the kicker—after all this, you might realize that tracking economic indicators isn’t about being a robot; it’s about staying human in the investment world. Sure, even pros mess up, but that’s what makes it real. So, here’s a straightforward call to action: grab that app or website right now and start monitoring one key indicator, like the latest GDP report, to see how it ties into your stocks. It’ll change how you play the game, I promise.

And one last thought: what’s that one economic signal that’s flipped your investment strategy on its head? Share in the comments—let’s keep this conversation going, because in investments, we’re all in this together, imperfections and all.