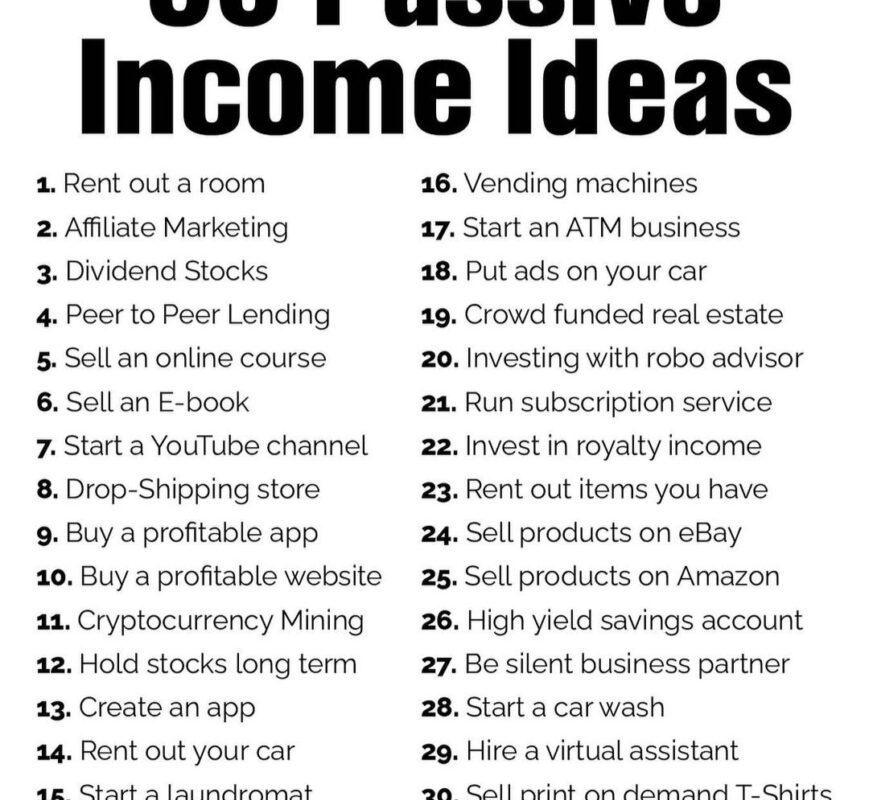

Whispered secrets underground, the world of investments often feels like a shadowy realm where fortunes bloom without lifting a finger. But here’s the contradiction: while everyone craves that sweet passive income stream, most folks bury their dreams under a pile of excuses and misinformation. Imagine turning your savings into a gentle river of cash that flows while you binge-watch your favorite series—yeah, like in «The Wolf of Wall Street,» but minus the chaos and questionable decisions. This article dives into real investment ideas for generating passive income, cutting through the hype to deliver practical, low-effort strategies. By the end, you’ll grasp how to build wealth that works for you, freeing up time for life’s joys. Stick around, and let’s explore why passive income ideas through investments could be your ticket to financial ease.

My Accidental Fortune from Forgotten Stocks

You know, back in my early twenties, I stumbled into investments almost by accident—picture this, a broke college grad tossing spare change into dividend stocks without a clue. I’d heard about them from a chatty uncle who swore by «set it and forget it» vibes, and honestly, I thought it was a piece of cake. Fast forward a few years, and those low-maintenance investment options had quietly ballooned into a steady trickle of cash. One winter, I checked my portfolio and found dividends adding up to cover my rent—mind-blowing, right? That personal anecdote taught me a harsh lesson: even imperfect decisions, like mine, can pay off if you pick solid, dividend-paying stocks from reliable companies.

But let’s get subjective here—I’m no financial wizard, and I messed up plenty, buying overhyped shares that tanked. Still, the beauty of passive income streams from stocks lies in their hands-off nature. Think about it like planting a garden; you sow the seeds once, and nature does the rest, with occasional weeding if you’re lucky. In the U.S., where I’m from, this approach resonates with that American dream of effortless growth, but with a twist—it’s not about striking gold overnight, it’s about that slow, reliable drip. And just like in a meme from r/WallStreetBets, where folks joke about «diamond hands,» holding onto good investments can turn skeptics into believers. If you’re dipping your toes, start with blue-chip stocks; they’re like the sturdy oaks in a forest of flashy saplings.

From Ancient Grains to Modern Dividends

Ever compare today’s investments to something as old-school as ancient farming? Back in the day, Roman farmers invested in grains, reaping harvests year after year with minimal effort—talk about the original passive income. Fast forward to now, and investment strategies for passive income echo that same principle, but with a modern, tech-savvy spin. In places like the UK, where tea and tradition mix, people have long favored bonds, seeing them as the quiet cousins to stocks—less drama, more stability, like sipping a warm brew on a rainy afternoon.

Here’s a truth that’s uncomfortably real: many chase get-rich-quick schemes, but history shows that diversified portfolios, including index funds, outperform the hype. Imagine a conversation with a skeptical reader: «Yeah, but what if the market crashes?» I’d say, «Fair point, mate, but that’s why we mix in bonds or REITs for real estate exposure—it’s like hedging your bets in a poker game.» This analogy isn’t just fluff; it’s grounded in how cultures worldwide balance risk, from Japanese keiretsu networks to American 401(k)s. To make it interactive, try this mini experiment: Grab your phone, look up a simple ETF tracker, and note how it mirrors broad market growth over a decade. You’ll see why hands-off investing approaches, such as these, build wealth like compounding interest on a savings account—slowly, surely, and with that satisfying «click» of realization.

| Investment Type | Pros | Cons |

|---|---|---|

| Dividend Stocks | Regular payouts; potential for growth | Market volatility; requires initial research |

| Bonds | Stable returns; low risk | Lower yields; inflation can erode value |

| REITs (Real Estate) | Passive rental income; diversification | Economic downturns affect property values |

The Lazy Investor’s Nightmare and Wake-Up Call

Alright, let’s address the elephant in the room—with a dash of humor, because who wants to get preachy? Imagine you’re that classic lazy investor, parked on the couch, dreaming of passive income but paralyzed by analysis paralysis. «Why bother?» you might think, «Investments are for suits and ties.» But here’s the irony: skipping out means missing out on opportunities that could fund your Netflix habit. In reality, generating passive income through investments is easier than you think, like hitting the jackpot with a lottery ticket you forgot about.

And just when you least expect it… that first dividend check lands, turning doubt into delight. To solve this, start small—say, allocate 10% of your savings to a high-yield savings account or peer-to-peer lending platforms, which offer residual income ideas with minimal fuss. I’ve seen friends in Canada do this, blending it with their laid-back lifestyle, proving it’s not about constant monitoring but smart setup. Use an unexpected analogy: It’s like setting a slow cooker in the morning and coming home to a ready meal—no drama, just results. By exposing this problem with a light-hearted nudge, you’re empowered to act, building a portfolio that’s as relaxed as your Sunday vibes.

In wrapping this up, here’s a twist: What if the real barrier to passive income isn’t the market, but your own comfy habits? Instead of waiting for the perfect moment, make it happen—start exploring one passive income investment idea today, like opening a brokerage account and picking a dividend fund. And think about this: What’s stopping you from transforming your savings into a lifelong asset, one that whispers «freedom» every month? Drop a comment below; I’d love to hear your thoughts on ditching the nine-to-five grind.