Money’s sneaky charm, tucked into bricks and mortar. Ever heard that real estate can turn a modest nest egg into a fortune, yet most people treat it like a high-wire act without a net? It’s true—while stocks might spike and dive like a caffeinated squirrel, property investments have quietly built wealth for generations. But here’s the rub: diving in without a plan is like buying a map to treasure without a compass. In this article, we’ll uncover practical ways to invest in real estate that won’t leave you stressed, helping you grow your portfolio with ease and maybe even a few laughs along the way. Stick around, and you’ll walk away with actionable insights to make your money work harder, smarter.

My First Flip: A Lesson in Sweaty Palms and Sweet Wins

Picture this: me, fresh out of college, staring at a rundown house in the suburbs that looked like it had starred in a horror movie. I remember thinking, «This is it, my ticket to easy street.» Spoiler: it wasn’t quite that simple. I bought that fixer-upper on a whim, figuring flipping houses was as straightforward as binge-watching HGTV. Boy, was I wrong. Fast forward through months of dusty weekends and surprise plumbing disasters—think pipes bursting like in that chaotic episode of «Friends» where Ross floods his apartment—and I actually turned a profit. But the real lesson? **Real estate investment** isn’t just about the buy-low-sell-high hype; it’s about patience and learning from the mess.

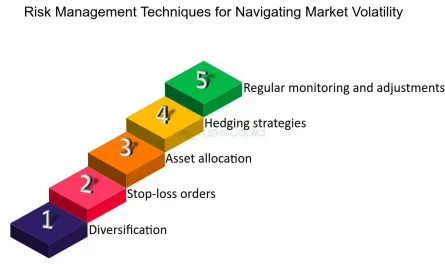

In my opinion, starting small with house flipping can be a game-changer if you’re hands-on, but it’s not for everyone. I mean, who knew that negotiating with contractors could feel like herding cats? Still, that experience taught me the value of due diligence—checking local market trends and property values before jumping in. It’s like planting a seed in rocky soil; if you nurture it right, you’ll get a sturdy tree. And don’t put all your eggs in one basket; diversify with a mix of flips and other strategies to soften the blows. This approach helped me build confidence, and hey, if a klutz like me can do it, you probably can too.

From Medieval Fortresses to Modern Lofts: A Quirky History Mashup

Ever wonder how investing in real estate evolved from feudal lords snapping up castles to millennials snapping selfies in co-working lofts? It’s a wild ride that mirrors cultural shifts, and trust me, it’s more entertaining than your average history class. Back in the day, say the Middle Ages, land was power—think kings trading estates like kids swapping trading cards. Fast forward to today, and we’re dealing with **property investment** in a global economy, where apps let you buy shares in buildings without ever stepping foot inside.

Comparatively, it’s like going from a knight’s armor to a smartphone shield. In ancient Rome, investing meant grabbing farmland for olives and wine—steady income, much like modern rental properties. But here’s a truth that’s a bit uncomfortable: while historical booms led to busts, like the Dutch Tulip Mania (okay, not exactly real estate, but you get the point), today’s market demands adaptability. For instance, urban areas in the U.S. are booming with tech-driven demand, turning old warehouses into trendy lofts. It’s hit the nail on the head—blending historical insights with current trends can guide your investments. If you’re skeptical, imagine chatting with a Renaissance merchant: «Why buy ships when you can buy land?» he’d say. Exactly, because real estate holds value like a timeless heirloom, even amidst economic tempests.

| Investment Type | Pros | Cons |

|---|---|---|

| Rental Properties | Stable passive income; potential for appreciation | Maintenance headaches; tenant issues |

| House Flipping | Quick profits if timed right; hands-on excitement | High risk of costs overruns; market fluctuations |

Busting Blunders: When Real Estate Laughs Back at You

And just when you think you’ve got it figured out—bam! A hidden termite infestation or a zoning law change throws a curveball. Let’s face it, **ways to invest in real estate** come with pitfalls that can turn your dream into a comedy sketch. Take my buddy’s story: he dove into REITs (real estate investment trusts) thinking it was a piece of cake, only to get stung by market volatility. «Yikes, that was not the plan,» he grumbled, as his portfolio dipped like a bad stock in a recession.

But here’s the ironic twist: these blunders can be your best teachers. For one, always research long-tail keywords like «best real estate investment strategies for beginners» to avoid rookie mistakes. Or, propose this mini experiment to yourself—track a property’s value over six months using free online tools. You’ll see how external factors, like interest rates, play a role. In a relaxed tone, I say treat it like a game of poker; know when to hold ‘em and when to fold ‘em. By addressing these issues head-on, you turn potential disasters into stepping stones, making your investment journey not just profitable, but fun.

Y justo ahí fue cuando I realized that blending humor with strategy makes all the difference. After all, who’s to say investing can’t be as enjoyable as scrolling through memes?

Wrapping It Up: Your Wealth, Reimagined

Here’s a final twist: what if real estate investing isn’t just about stacking cash, but about crafting a legacy that outlasts you? We’ve covered the highs and lows, from my flip fiasco to historical parallels, showing that **real estate investment options** are as varied as your favorite playlist. Now, take action—start by evaluating one local property listing today and jot down potential pros and cons. It might just spark that wealth-building fire.

And one last question to ponder: if you could invest in a property that changes your family’s future, what dream home would you pick? Share in the comments; let’s keep the conversation going.