Money whispers secrets. Wait, hear me out – in a world where everyone’s chasing the next big crypto craze, mutual funds sit quietly in the corner, offering steady growth without the drama. But here’s the kicker: most folks think investing is as complicated as solving a Rubik’s cube blindfolded, missing out on building real wealth over time. This tutorial on mutual funds basics cuts through the jargon, showing you how to dip your toes into investing with confidence. By the end, you’ll grasp why these pooled investments could be your ticket to financial freedom, all while keeping things light and approachable. Let’s unpack this together, because who said learning about money has to feel like a chore?

My First Dive into Mutual Funds – And What I Learned the Hard Way

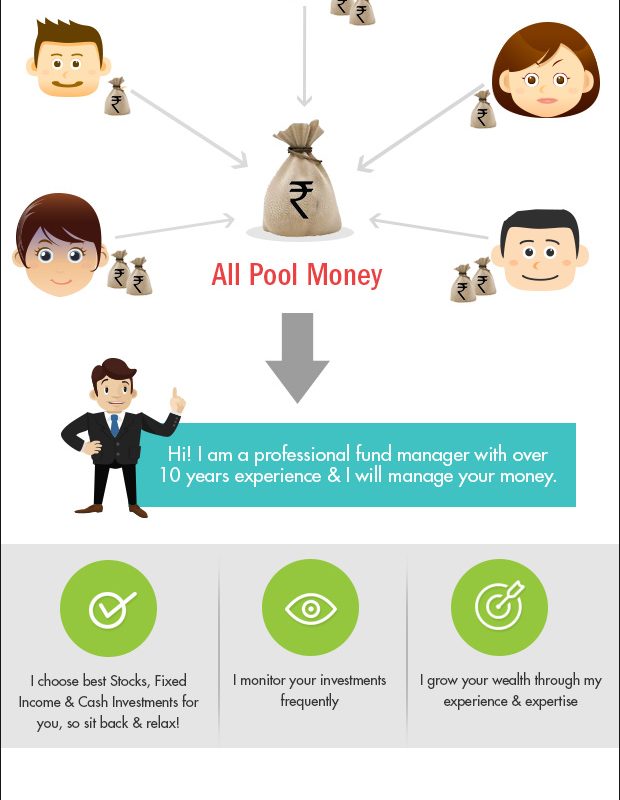

Picture this: back in 2015, I was glued to my screen, binge-watching «Breaking Bad» reruns, when a buddy hit me with, «Dude, you’re just throwing money away on takeout – put it in mutual funds instead.» Skeptical as heck, I dove in anyway. See, I’d always thought stocks were for Wall Street wizards, not everyday Joes like me. But mutual funds? They pool cash from a bunch of investors to buy a mix of stocks, bonds, and other assets – it’s like a group road trip where everyone shares the gas money.

Fast forward, and my first investment was a mid-cap fund, which focuses on medium-sized companies with growth potential. I remember the nerves, thinking, «What if it tanks like Walter White’s meth empire?» But over five years, it grew steadily, teaching me that investing in mutual funds isn’t about quick wins; it’s about patience. Here’s a personal opinion: I believe mutual funds are a piece of cake for beginners because professional managers handle the heavy lifting, diversifying your risk so one bad stock doesn’t wreck your portfolio. And just like in «The Office,» where Michael’s ideas flop but the team pulls through, mutual funds spread out the bets. You know, it’s like planting a garden of wildflowers instead of a single rose – more resilient to storms.

To make this real, let’s compare it to my early blunder. I once chased a hot tip on individual stocks, losing a chunk because, well, I’m no stock-picking savant. With mutual funds, though, the basics of mutual funds emphasize diversification as key. If you’re starting out, remember: start small, research funds with low fees, and think long-term. It’s not glamorous, but it’s effective.

Mutual Funds vs. That Old Piggy Bank: A Historical Spin

Ever heard the saying «a penny saved is a penny earned»? That’s straight from Benjamin Franklin, but in today’s world, stashing cash in a piggy bank is like relying on a horse and buggy while everyone’s zooming in Teslas. Mutual funds, born in the 1920s as a way for regular folks to access professional investing, have evolved into a powerhouse for mutual funds for beginners. Think about it: during the Great Depression, people lost everything in bank runs, but diversified funds helped stabilize economies later on.

Here’s an unexpected analogy – mutual funds are like a community potluck versus eating alone. At a potluck, you bring what you can and share in the feast, which mirrors how investors contribute to a fund and benefit from collective gains. In the U.S., where I’m from, this communal vibe ties into our cultural love for teamwork, like in baseball where one player can’t win the game alone. But twist it with a bit of irony: while your piggy bank might feel safe, inflation is that sneaky thief that erodes its value over time. According to recent data, the average annual inflation rate hovers around 2-3%, meaning your savings lose purchasing power if they’re just sitting there.

Now, for a quick cultural nod, it’s like how Southerners say «fixin’ to» before doing something – you’re preparing for the future. The benefits of mutual funds include liquidity, professional management, and potential for higher returns than a simple savings account. Don’t just take my word; imagine chatting with a skeptical friend: «Yeah, but what if the market crashes?» I’d counter, «That’s why you diversify, buddy – not all funds tank at once.» In essence, types of mutual funds like equity, debt, or hybrid offer options for every risk level, making it accessible no matter your starting point.

Why Your Daily Latte Might Outpace Poor Investments – And How to Fix That

Hold up, I’m not saying skip your coffee – but if you’re dropping $5 a day on that fancy brew, that’s over $1,800 a year you could funnel into a mutual fund. The problem? Many people underestimate compound interest, thinking short-term gains are the way to go, only to wake up years later wondering where their money went. It’s almost comical, like expecting to win the lottery while ignoring the basics.

Let’s break it down with a simple experiment you can try: grab a calculator and project how $100 monthly investments in a mutual fund with an 8% average return could grow to over $100,000 in 30 years. That’s the magic of compounding, folks – it’s not a get-rich-quick scheme, but a steady climb. In my view, the key to mastering how to start investing in mutual funds is overcoming inertia. Start by choosing a reputable fund through platforms like Vanguard or Fidelity, then set up automatic contributions. It’s straightforward, yet so many folks hem and haw.

For clarity, here’s a quick table comparing two paths:

| Option | Pros | Cons |

|---|---|---|

| Savings Account | Easy access, low risk | Low returns, beaten by inflation |

| Mutual Funds | Potential for growth, diversification | Market volatility, fees involved |

And just like in «Friends,» where Ross and Rachel’s on-again-off-again drama drags on, don’t let hesitation hold you back. Y justo ahí fue cuando I realized consistency beats perfection every time.

Wrapping It Up with a Fresh Angle

Here’s the twist: what if I told you that mutual funds basics aren’t just about money, but about reclaiming control in an uncertain world? Instead of viewing investments as a chore, see it as your personal rebellion against financial mediocrity. So, take action now – open a brokerage account and invest $50 in a low-cost index fund today. It’s that simple. And on a reflective note, how has ignoring investments shaped your future plans? Share your thoughts in the comments; let’s keep the conversation going.