Money whispers secrets. Yep, those crumpled bills in your wallet aren’t just paper—they’re gatekeepers to freedom, or at least, that’s what I learned the hard way. But here’s the kicker: while everyone dreams of hitting the jackpot, most folks trip over the basics of long-term wealth building through investments. It’s a truth that’s as uncomfortable as realizing your favorite coffee habit costs more than your retirement fund. In this article, we’ll dive into strategies for long-term wealth building that actually work, cutting through the jargon to show you how smart investments can turn your financial future from a vague hope into a solid plan. Stick around, and you’ll walk away with practical tips to grow your wealth steadily, without the stress.

My Accidental Fortune: The Time I Stumbled into Stocks

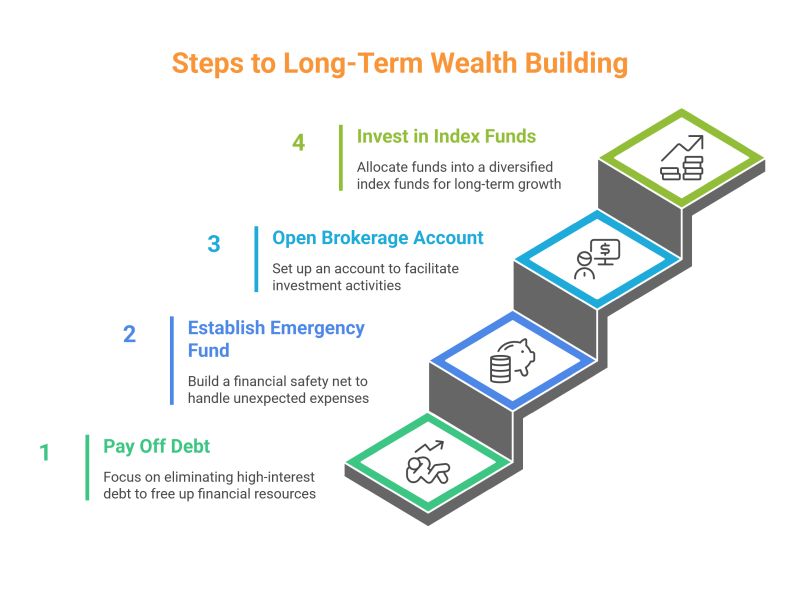

Okay, picture this: back in my early twenties, I was that guy glued to the TV, binge-watching «The Wolf of Wall Street» and thinking, «Yeah, I could do that.» But reality hit different. I wasn’t Jordan Belfort; I was just a broke barista pouring lattes in Seattle, dreaming big but investing zip. One rainy afternoon—Washington weather, am I right?—I finally opened a brokerage app on a whim. Fast-forward a decade, and that haphazard start turned into a modest nest egg. See, I diversified early, throwing a bit into index funds, some stocks, and even real estate investment trusts (REITs). It wasn’t glamorous; it was more like planting seeds and forgetting about them until they sprouted.

My point? Long-term investment strategies aren’t about overnight wins—they’re about patience, like waiting for your sourdough to rise. I remember the first time my portfolio ticked up during a market dip; it felt like cheating the system. But here’s my subjective take: too many people chase quick flips, ignoring the power of compounding. It’s like expecting a houseplant to bloom in a week—possible, but unlikely. In the U.S., we’ve got this cultural obsession with instant gratification, from Black Friday deals to viral TikTok trends, but real wealth building? That’s a slow burn. And just when you think it’s all smooth sailing… boom, a correction hits, and you’re reminded that building wealth through investments requires staying power.

From Tulip Bulbs to Bitcoin Frenzies: A Wild Historical Ride

Ever heard of Tulip Mania? Back in 17th-century Netherlands, people went nuts over tulip bulbs, trading them like they were gold. Sounds ridiculous, right? But fast-forward to today, and it’s eerily similar to the crypto craze that had everyone yelling «To the moon!» during the 2021 bull run. As someone who’s dabbled in both traditional stocks and emerging assets, I see the parallels: hype can inflate bubbles, but strategies for long-term wealth building mean looking beyond the flash. In contrast, think about how Warren Buffett built his empire—steady, value-driven picks over decades, not chasing fads.

This comparison isn’t just history geek stuff; it’s a wake-up call. In American culture, we idolize rags-to-riches stories, like the guy who turned a garage startup into a tech giant, but the truth is messier. Diversification across asset classes—bonds for stability, stocks for growth, maybe some international funds—has been the quiet hero. It’s like comparing a reliable old pickup truck to a flashy sports car; the truck might not turn heads, but it’ll get you where you need to go. And here’s a twist: in places like Japan, where long-term saving is almost a national sport, folks emphasize low-risk investments that compound over time. Me? I mix it up, adding a dash of irony—why bet everything on one horse when you can hedge with a stable?

But let’s not gloss over the downsides. A simple table might help clarify:

| Investment Type | Advantages | Disadvantages |

|---|---|---|

| Stocks | High growth potential, liquidity | Volatility, requires research |

| Bonds | Stable returns, lower risk | Lower yields, inflation impact |

| REITs | Diversification, passive income | Market sensitivity, management fees |

See? No one’s perfect, but balancing these can make long-term investments feel less like a gamble and more like a smart bet.

Chasing the Next Big Thing: Why It’s Like Scrolling Endless Feeds

You know that feeling when you’re deep into a Netflix binge, convinced the next episode is the one that’ll change your life? That’s exactly how chasing hot stocks feels—thrilling, but often a dead end. Imagine we’re chatting over coffee: «Hey, skeptic friend, you think picking the latest meme stock is easy money?» Well, it’s not. The problem? Emotional investing leads to losses, like buying high and selling low. But here’s the irony: with a little discipline, you can turn that around.

Let’s try a quick experiment—grab a pen. (1) Track your daily spending for a week; (2) Allocate 10% to a low-cost ETF; (3) Review in six months and see the growth. I did something similar years ago, and boy, was I surprised. And that’s when it hit me… the real strategy is automating contributions, letting dollar-cost averaging smooth out the bumps. In a world obsessed with get-rich-quick schemes—think of those Instagram influencers flexing Lambos—building wealth through investments means ignoring the noise. It’s like that old saying, «Don’t put all your eggs in one basket,» mixed with a modern twist: diversify or risk going viral for the wrong reasons.

Concluding this chat, here’s the twist: wealth isn’t just about the numbers; it’s about crafting a life where money works for you, not the other way around. So, take action—set up an automatic transfer to an investment account today, even if it’s just a few bucks. And here’s a question that might keep you up: what’s the one investment mistake you’ve made that you wish you could undo? Share in the comments; let’s keep this real.