Whispers of wealth, but wait—investing ethically isn’t just about stacking cash; it’s a tightrope walk between profit and planet. Here’s the kicker: while traditional stocks might fatten your wallet, they often leave a trail of environmental wreckage, from oil spills to sweatshop scandals. That’s the uncomfortable truth—your money could be funding the very issues you rally against on social media. But flip that script, and you unlock a world where your investments actually make a difference, building a portfolio that’s both savvy and soulful. In this chat, we’ll explore fresh ideas for ethical investment options that let you sleep easy, turning your financial future into a force for good without sacrificing returns. Stick around, and you’ll walk away with actionable tips to start investing with a conscience.

My Accidental Green Portfolio: A Tale of Coffee and Consciousness

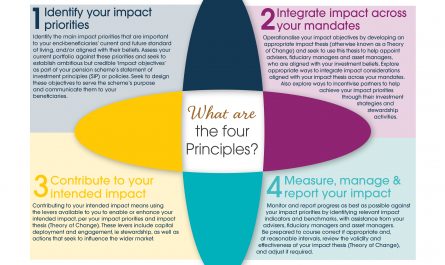

Picture this: a few years back, I was just your average joe—pun intended—sipping coffee and scrolling through my bank app, oblivious to where my savings were parked. Then, one rainy Seattle afternoon, I stumbled upon a report about how my mutual funds were tied to deforestation in the Amazon. Yikes, right? That hit home hard, especially since I’m that friend who always nags about recycling. So, I dove headfirst into ethical investing, swapping out those shady stocks for sustainable options like ESG-focused funds. ESG, by the way, stands for Environmental, Social, and Governance criteria—it’s the backbone of ethical investment options that screen for companies doing right by the planet.

Fast-forward, and my portfolio’s now a mix of green bonds and impact investments, like those funding renewable energy projects. I remember thinking, «If I can afford a fancy latte, why not put that money toward solar farms?» It’s not perfect—there are days when returns dip, and I mutter, «Well, that’s the price of playing hero.» But the lesson? Ethical investing isn’t about perfection; it’s about progress. Take my word, as someone who’s seen their sustainable investments grow steadily, it’s worth the swap. And just like that Netflix binge of «Planet Earth» that kept me up all night, this shift made me realize our cash has power beyond numbers.

From Wall Street Hustle to Community Cool: A Cultural Flip

Ever notice how investing used to be all about the big, bad Wall Street wolves, chasing dollars like in a Scorsese flick? But shift gears to today, and we’re seeing a cultural evolution, blending finance with feel-good vibes. Think about it: in places like the U.S., where the American dream often means «get rich quick,» there’s now a growing movement toward socially responsible investing. It’s like comparing a classic muscle car to a sleek electric vehicle—both get you places, but one leaves less exhaust.

Historically, this echoes the 1960s anti-war protests, where folks boycotted companies profiting from conflict. Fast-forward, and we’re doing the same with climate change, ditching fossil fuels for clean tech. In my neck of the woods, out West, we’ve got communities pouring into local co-ops, investing in organic farms instead of mega-corporations. It’s ironic, isn’t it? The same country that birthed fast-food chains is now championing slow, sustainable growth. And that’s when it hits you—ethical investment options aren’t just a trend; they’re a quiet revolution, weaving community ties into your 401(k). Plus, with tools like impact investing platforms, you can track real-world effects, making your money work like a neighborhood hero rather than a distant tycoon.

| Investment Type | Pros | Cons |

|---|---|---|

| ESG Funds | Aligns with values, potential for steady growth | Higher fees sometimes |

| Green Bonds | Direct environmental impact, tax perks | Lower returns in volatile markets |

| Community Investments | Supports local economies, personal satisfaction | Less liquidity, harder to track |

The Funny Side of Filthy Lucre: Irony and Fixes

Okay, let’s get real for a second—investing ethically can feel like trying to diet at a buffet. You’re eyeing that juicy stock, knowing it’s got red flags, and thinking, «Do I really have to pass on the profits?» It’s hilariously ironic how we preach about saving the bees but let our portfolios buzz with polluters. But here’s the twist: by choosing ethical investment options, you’re not missing out; you’re upgrading. Take my buddy who swapped his oil stocks for renewable energy shares—now he’s laughing all the way to the bank, with dividends that beat expectations.

To fix this, start small: audit your current holdings with a free online tool, then pivot to alternatives like microfinance loans that empower entrepreneurs in developing countries. It’s like kicking the can down the road, but in a good way—delaying gratification for long-term gains. And don’t forget, as Warren Buffett might say with a wink, «Price is what you pay, value is what you get,» but in ethical terms, that value includes a cleaner world. Y’know, that meme from «The Office» where Michael Scott tries to fix everything? That’s us with investments—messy at first, but oh so rewarding.

In wrapping this up, here’s the plot twist: what if your nest egg could hatch a better future? Instead of just hoarding wealth, ethical investing flips the script, making your money a legacy. So, here’s a straightforward CTA—grab that app on your phone and research one ethical investment option right now, even if it’s just a small transfer. And to leave you pondering: in a world obsessed with getting ahead, what if getting ethical was the real shortcut to peace of mind? Drop your thoughts below; I’d love to hear how you’re reshaping your financial story.